Scandinavian Credit Fund I AB (publ) reports a NAV rate for August of 78.21. That's down 2.17 %. The decline is attributable to reservations by two property developers, one Norwegian and one Swedish. The fund had no new lending during September. No disposals took place during the month. A settlement was reached in a dispute without any impact on the NAV value.

Pledged assets

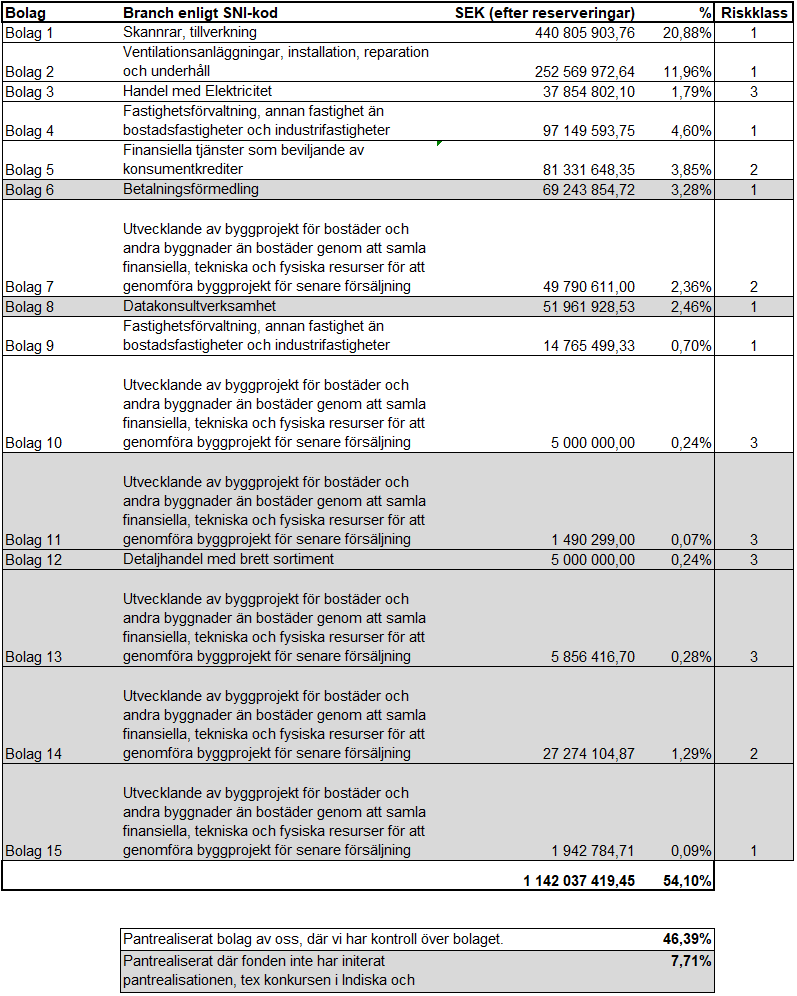

The fund has mortgaged credits corresponding to approximately 50% of the current NAV after reservations. The companies amount to just over 40% and real estate to around 10%. During the month, no mortgage realizations took place. In previous monthly letters we have mentioned approx. 60% as mortgage realized value, but then we have used the broader concept and included companies where we have not initiated the mortgage realization and where there are potentially other stakeholders who can take over existing credits. See table below.

The three directly owned companies (Blue Energy, Global Scanning and Scooper) in which the fund is the majority owner have been cash flow positive during the month. The majority of the property portfolio is found in Norrtälje. The holiday cottages in Björnrike will shortly be sold or rented out. Please see more at https://idetfjallby.se/

The distribution of the portfolio

The distribution of the portfolio regarding the mortgaged assets looks according to the table below. The rest of the portfolio is loans that have not been mortgaged and are running as before. It is important to point out that the pledged assets consist of companies in category 1-3, i.e. category 1 are companies that pay their interest and amortization according to agreements and here are the largest holdings.

Management strategy

The fund works actively to manage and refine the assets. Hans Westerberg is now chairman of the board of the three shareholdings. What these companies have in common is to lower the cost mass to get a lower break-even level and thus become less sensitive to loss of revenue.

In cases where it is possible, the fund has adjusted up the interest rate on outstanding credits and expanded the underlying collateral.

Payment

Payments are made via Euroclear as repayment of capital. No withholding tax is therefore deducted. Taxation of the shares is done according to current taxation rules, depending on which form of savings was used. The fund cannot answer questions regarding taxation, as the fund does not have insight into individual investors' savings, but it is a matter between the investor and its advisor and custodian institution

Payment is made when the fund has accumulated enough cash for the payment to be meaningful. This is because the payments are associated with administrative work and costs. The next payment will take place in Q1 2024 at the earliest.

The settlement date for payments will henceforth take place on the same day as the monthly NAV, i.e. the last day of the month, and will be published on the first working day of the month. The payment is made five working days later.

The payment is paid pro rata to the Fund's shareholders. More information about the payment is communicated on the Fund's website: https://kreditfonden.se/