Scandinavian Credit Fund I AB (publ) reports a NAV rate for November of 63.27, a decrease of -0.1 % since the previous month. The fund's managed capital amounts to SEK 1,708 million at the end of the month.

No major value changes in the portfolio during the month, in other words. Happily, we have realized two transactions, which strengthened the cash register. Refunds will be made on December 13. More information under repayment of capital, see below.

As mentioned in previous monthly letters, the fund has stopped currency hedging the holdings as it was considered too expensive and that it also has liquidity effects in connection with the realization of the currency futures. The outcome in the portfolio is affected after we stop currency hedging both up and down depending on how the currencies change.

The Swedish krona weakened during November against the dollar, the Norwegian krone and the pound, but strengthened against the euro and the Danish krone. Overall small effects on NAV during the month.

| Currency | 2024-11-30 | 2024-10-31 | % change |

| DKK/SEK | 1,5452 | 1,5538 | -0,55% |

| EUR/SEK | 11,5254 | 11,589 | -0,55% |

| GBP/SEK | 13,88 | 13,7345 | 1,06% |

| NOK/SEK | 0,987 | 0,9678 | 1,98% |

| USD/SEK | 10,8908 | 10,6508 | 2,25% |

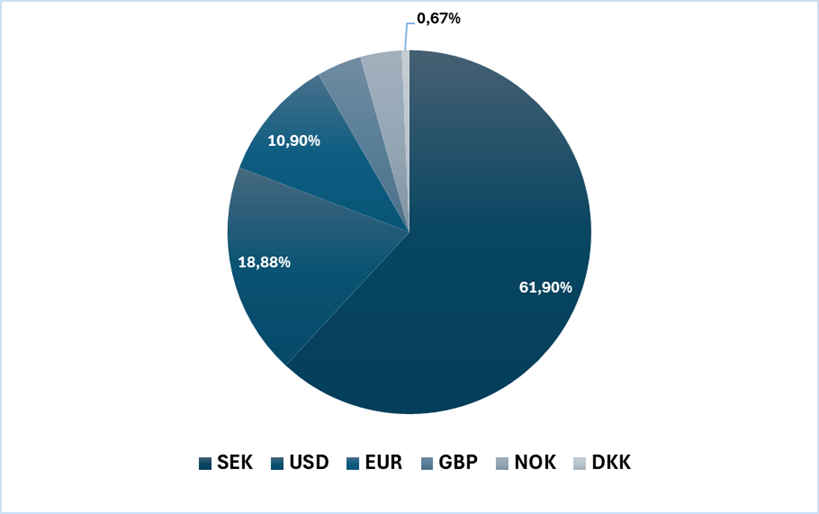

Loans and shares in the portfolio before reserves are distributed in underlying currencies as below.

| Currency | % of NAV | HUB* |

| SEK | 61,90% | 1 295 184 985 |

| USD | 18,88% | 395 067 199 |

| EUR | 10,90% | 227 967 513 |

| GBP | 3,98% | 83 263 427 |

| ENOUGH | 3,68% | 76 900 131 |

| DKK | 0,67% | 13 919 171 |

| 100% | 2 092 302 426 |

* Before Reservations

According to the model that the fund applies for reserving the loans, the reserving per category is as follows. The holdings realized in November have meant that the acquisition value has been written off and the provision for the holdings has been dissolved. Total reservations per category are shown below.

| The portfolio and reserves according to IRFS 9 | |||

| Securities according to valuation | 2 092 302 426 | ||

| Net worth | 1 710 052 971 | ||

| IFRS | Total reservations | 518 182 436 | 24,77% |

| Category 1 | Reservations Cat 1 | 5 862 910 | 0,28% |

| Category 2 | Reservations Cat 2 | 21 021 419 | 1,23% |

| Category 3 | Reservations Cat 3 | 491 298 106 | 23,48% |

Since the closure, we have moved more engagements into category 3, which has also increased the provision for credit losses as the assessed security value has decreased.

Events during the month

The sale of the condominiums developed in Vemdalen is now underway. The broker has had a number of viewings and a few offers have also been received, but below the starting price. Our broker believes that the activity will start and that it is normal for the time of year. Advertisement is available on Hemnet and the broker's website. We will now also advertise in the magazine Åka Skidor, both online and in the issue that comes out in early February. The ads on Hemnet, see below.

https://www.hemnet.se/bostad/fritidsboende–4 rooms–bjorn kingdom–harjedalen's–municipality–bjorn kingdomthe mossy path–5a–21119775 https://www.hemnet.se/bostad/fritidsboende-2rum-bjornrike-harjedalens-kommun-bjornrikemosippevagen-9c-21339152

We expect the Riksbank to continue with its interest rate cuts. New information will now come in December. Assuming that there is a further reduction of -0.25%, the policy rate in 2024 has in that case been reduced by -1.5% during the year. The more favorable interest rate situation will hopefully lead to increased interest in the developed condominiums and the property market in general.

In addition to the condominiums in Vemdalen, as previously reported, the fund has properties in

Norrtälje and Hallstavik. Here, we have worked on bringing in new tenants and improving the operating net.

In the monthly newsletter for September, we were pleased to report that we have brought in Kronans Apotek as a new tenant in one of the properties. Adaptation of the premises is now underway so that occupancy can take place during Q1 2025. With a slightly more favorable location, we are now hiring brokers for the sale of one of the properties.

We can state that the positive trend that we have seen in some of the unlisted companies that the fund has secured is continuing. Turnover and profit will surpass previous years. The cooperation with the management, which is partly new to one of the companies, works well. The fund has not changed the valuation of the holdings as a result of the improvement in results, as we need a more long-term view of the development to make any adjustments. For future divestments, however, it is positive that the companies are developing well. We will need to continue working with the companies for some time to come before sales can be carried out.

During November, we realized a pledge and in connection with that received a settlement amounting to SEK 29.4 million. The mortgaged assets refer to plots of land which have now been transferred to the fund in a newly started company. In connection with the takeover, we have received a valuation that corresponds to the value at which the plots are recorded. We intend to sell the assets in 2025. During the beginning of December, we received an amortization of a loan from a borrower of SEK 50 million plus interest.

Repayment of capital

The fund will repay SEK 85 M corresponding to approx. 5% of NAV as of November 30, a total of 3,15% of the nominal outstanding amount. The payment takes place in the form of an amortization to the fund's investors. The repayment will be made via Euroclear on December 13 to the bank or securities institution where the respective holder has its depository. This means that it may take a few more days before the money appears in the account, depending on how quickly the bank processes the payment. The repayment shall be treated as an amortization of the profit share loans and shall not entail any taxation. In our assignment to Euroclear, we have instructed that no withholding tax is to be deducted on the payment.

If everything goes as planned, we expect further repayments during the beginning of the second quarter of 2025. We will return with more information regarding this in future monthly newsletters.

More information and Q&A is available on the Fund's website: https://kreditfonden.se as well as in previous monthly newsletters.