Scandinavian Credit Fund I AB (publ) reports a NAV rate for October of 63.33, an increase of 1.67% since the previous month. The fund's managed capital amounts to SEK 1,709.4 million at the end of the month. The change is partly influenced by currency changes but also by an increase in value in one of the fund's listed assets.

As mentioned in previous monthly letters, the fund has stopped currency hedging the holdings as it was considered too expensive and that it also has a liquidity effect in connection with the realization of the currency futures. The outcome in the portfolio is affected after we stop currency hedging both up and down depending on how the currencies change.

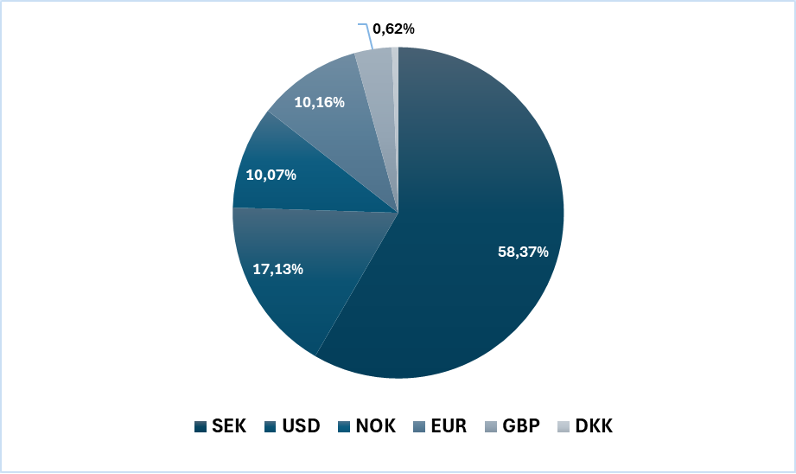

The Swedish krona weakened during October against all currencies to which the fund has exposure. The Norwegian krone strengthened by 0.6% and the dollar strengthened by 4.88%, the change in the fund's currencies is shown below. The positive change in NAV during the month of 1.67% is partly affected by currency changes as the holdings in foreign currency increased in value when revalued to Swedish kronor.

| Currency | 2024-10-31 | 2024-09-30 | % change |

| DKK/SEK | 1,5538 | 1,5164 | 2,47% |

| EUR/SEK | 11,589 | 11,3052 | 2,51% |

| GBP/SEK | 13,7345 | 13,5793 | 1,14% |

| NOK/SEK | 0,9678 | 0,9622 | 0,58% |

| USD/SEK | 10,6508 | 10,1554 | 4,88% |

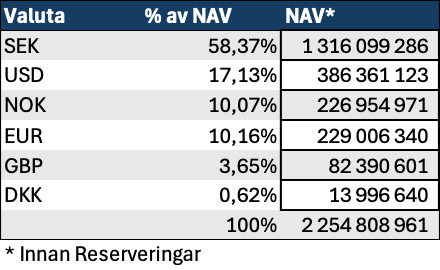

Loans and shares in the portfolio before reserves are distributed in underlying currencies as below.

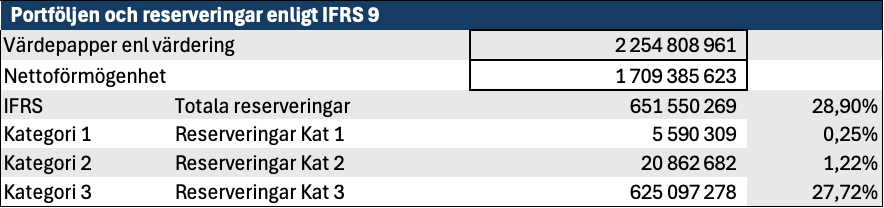

According to the model that the fund applies for reserving the loans, the reserving amounts per category as follows.

Since the closure, we have moved more engagements into category 3, which has also increased the provision for credit losses as the assessed security value has decreased.

During the month, the provision was increased in a commitment where the fund had previously made an agreement on an installment plan. Since the borrower has not fulfilled the first part of the agreement, the fund has now forwarded the case for collection by the Crown Enforcement Officer. In addition to corporate mortgages, the fund has surety bonds from the owner and another company within the same group. The provision has been increased according to the fund's model for provisions. We will pursue the case as far as it goes and is financially justifiable.

Events during the month

During October, we resumed efforts to sell the condominiums developed in Vemdalen. The sale has been deliberately paused during the summer in consultation with the broker engaged as interest is normally lower during the third quarter. The condominiums were shown during the turn of October/November in connection with a fair in the area. https://www.hemnet.se/bostad/fritidsboende-4rum-bjornrike-harjedalens-kommun-bjornrike-mosippevagen-5a-21119775

https://www.hemnet.se/bostad/fritidsboende-2rum-bjornrike-harjedalens-kommun-bjornrike-mosippevagen-9c-21339152

During 2024, the Riksbank has lowered the policy rate by -1.25%, from 4% down to 2.75% now at the beginning of November. The more favorable interest rate situation will hopefully lead to increased interest in the developed condominiums and the property market in general.

In addition to the condominiums in Vemdalen, as previously reported, the fund has properties in Norrtälje and Hallstavik. We have worked here to bring in new tenants and improve the operating net. In the monthly newsletter for September, we were pleased to report that we have brought in Kronans Apotek as a new tenant in one of the properties. Adaptation of the premises is now underway so that occupancy can take place during Q1 2025. With a slightly more favorable location, we are now hiring brokers for the sale of one of the properties.

We can state that a few more of the unlisted companies that the fund pledged have developed nicely in 2024. Turnover and results will surpass previous years unless something unexpected happens in the last few months. The cooperation with the management, which is partly new to one of the companies, works well. The fund has not changed the valuation of the holdings as a result of the improvement in results, as we need a more long-term view of the development to make any adjustments. For future divestitures, however, it is positive that the companies are developing well. We will need to continue working with the companies for some time to come before sales can be carried out.

One of the listed holdings that was mentioned in the previous monthly letter had a positive price trend during the month, influenced by the order of SEK 825 million that the company announced in the press in October. The revaluation of the holding, which was made at the rate at the end of October, contributes to the month's positive return.

Repayment of capital

We have made no changes to the information communicated in connection with the publication of the half-yearly report and in previous monthly newsletters. A repayment of capital will be possible during the end of Q4 or the beginning of 2025. We will return with further information as it approaches for payment.

More information and Q&A is available on the Fund's website: https://kreditfonden.se as well as in previous monthly newsletters.