Scandinavian Credit Fund I AB (publ) reports a NAV rate for July of NAV 63.52, a decrease of -1.96%. The NAV price means a total change of -38.34% since closing, of which -10% of the total change is the fund's first repayment to unit owners. The result for 2023 was -17.55% and -13.82% YTD.

During the month of July, the fund issued a downloadable annual follow-up and review of the various phases of the liquidation, terminology and general information. The document can be downloaded and viewed via the fund's website at kreditfonden.se

The month's NAV change is derived from an increase in provisions in accordance with the IFRS9 model. The reservation in categories 1 and 2 are relatively unchanged, while category 3 has increased by approx. 44 msec. The total reservation is approx. 39,86% of NAV.

The table shows the proportion of reserved funds in accordance with the IFRS9 regulations. The management is model-based and applicable to all loans in the portfolio.

Ongoing Administration

The liquidation of the fund continues and works actively with all portfolio holdings with the goal of maximizing the recovered value for repayment to unit owners pro-rata. During the month, one of the fund's portfolio holdings showed aggravating circumstances, which signaled a weakened value for the fund's exposure and holdings. The fund has thus been forced to make additional reserves according to IFRS9, which meant a decline in NAV. With reference to insider information, the Fund cannot at the time of writing comment on the holdings as further information has not yet been disclosed to the general market.

Currency exposure

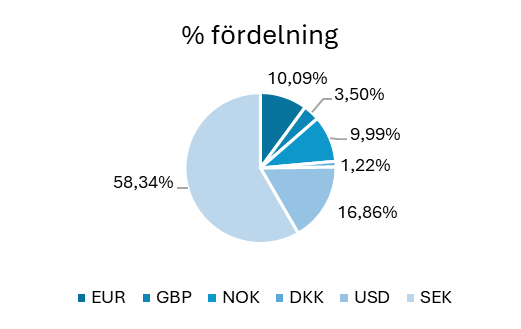

The fund has previously currency hedged all holdings with exposure to currencies other than SEK. Currency hedging (Currency Hedge) means that the fund sold the corresponding nominal value in the currency in which the loan was paid out. As a result of a currency hedge (all things being equal), movements in the currency have a very limited effect on the portfolio's NAV. The sale of the currency is generally made against major credit institutions and under the agreement "ISDA" (International Swaps & Derivatives Association) and through a futures contract (derivative). As previously, the fund has been informed that it has ceased to hedge the portfolio, which in practice means that all holdings in currencies other than SEK may both increase and decrease in value over time and thus fully correlated with the respective currency's movements. Volatility in the fund's NAV is therefore likely to increase somewhat in the future and depending on the development of the Swedish krona against the respective currency. As of July, the fund has NAV assets in SEK, USD, NOK, EUR, GBP and DKK and where the fund's primary exposure is reported in the pie chart as a percentage (%) of the fund's total assets, excluding cash.

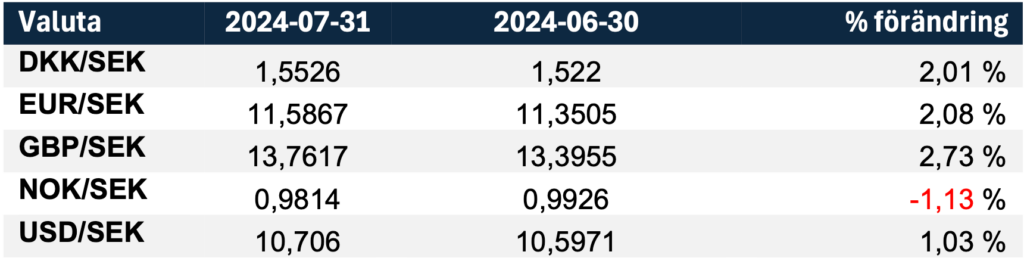

During July, the Swedish krona weakened against the majority of the fund's currencies, with the exception of NOK. The table below reports the percentage change in each currency from the NAV time in June and the NAV time in July.

The table shows the change in the respective exchange rate between the month's NAV and the previous NAV.

Cash & liquid assets

The fund's cash expressed as a percentage (%) at July's NAV amounted to approx. 1.91%, which is a decrease of approx. 2.36% compared to the previous month's percentage share of approx. 4.27%. The change consists of temporary liquidity management with the aim of generating a favorable return on the fund's liquid assets while waiting for further amortizations. The fund has successfully processed the existing portfolio and where expected amortizations during Q3 are expected to amount to approx. SEK 75m. Given the receipt of the agreed amortization, the Fund intends to make a second repayment to the Fund's shareholders pro-rata. The payment date, all things being equal, is estimated to take place at the beginning of Q4 2024.

The table shows the Fund's respective currency in relation to the Fund's total cash assets and in percentage

Pledged assets

The fund's portfolio assets are managed on an ongoing basis where the market situation during July/August is somewhat uncertain and where the stock market has occasionally been experienced as turbulent. The possibility of selling the mortgaged properties is judged to be correlated with the Riksbank's upcoming signals and announcements regarding upcoming interest rates. The fund generally sees an improved trend and increased profitability in the majority of the fund's pledged assets as the market situation improves somewhat.

The fund works continuously with the sale of cottage properties in Björnrike. To increase interest in the area and the cabins, a couple of these are rented out via Skistar. The fund will evaluate the rental income to assess whether more cabins should be equipped for rental.

The sale of the cottages takes place via Idetfjällby | Mountain cabins in Björnrike/Vemdalen.

For more information about the rental, visit Björnrike / Vemdalen (Skistar.com)

Read more about the cottage properties at idetfjallby.se

Development of the loan portfolio

The fund's ambition when liquidating the fund is, as previously communicated, to maximize the recovered amount to the fund's shareholders. The opportunity cost is deemed to be in excess as a so-called "slaughter value" on the portfolio holdings would risk significant losses for the fund and unit owners. Instead, the fund works actively and if called upon through local legal representatives to recover the largest possible share of outstanding loans and portfolio assets. During the month, the fund has successfully negotiated earlier amortization and the fund is expected to arrive at the end of Q3 2024 and Q4 2024. As the amortizations are received by the fund in their entirety, this will be repaid to the unit owners pro-rata. The time for a second repayment is estimated to take place, all things being equal, at the beginning of Q4 2024 and communicated through newsletters and/or monthly communications.

Management and liquidation strategy

The fund works actively with remaining loans and the liquidation of the portfolio's mortgaged assets. The fund has previously communicated the maturity structure and with the final maturity Q3 2026. However, a divestment of pledged assets is dependent on several factors where the assets, all things being equal, are divested through a sale to another interested party and/or recipient. The value of the asset is thus controlled by both micro and macroeconomic factors, i.e. interest rate, inflation, and a general geopolitical situation. The fund's goal is to maximize the value in the event of a sale for repayment to the investors, which means that the liquidation of each asset may run longer than the last loan maturity in Q3 2026.

In the event of a dispute with the borrower, the fund may act through legal representation. The fund's goal is always to ensure a positioning for maximum recovery of the fund's claim, alternatively ensuring the fund's positioning within the pledged company structure.

Refund

The fund regularly receives questions from profit share owners regarding the frequency of repayment of the profit shares. The fund initially communicated an ambition for quarterly payments, which has not been fulfilled. Generally speaking, the fund cannot communicate any forecast regarding when the next payment may take place and therefore recommends all investors to take part in/subscribe to the fund's newsletter for ongoing information, read monthly comments and 'questions and answers' on the fund's website.

In the case of repayments, this is paid via Euroclear as repayment of profit share loans and is not to be confused with "disbursement" or "dividend". No withholding tax is therefore deducted. Taxation of the shares is done according to current taxation rules, depending on which form of savings was used. The fund cannot answer questions regarding taxation as the fund does not have insight into individual investors' savings, but it is a matter between the investor and its advisers and custodian institutions.

Repayment takes place when the fund has accumulated a significant volume of cash. This is because the repayments are associated with administrative work and costs which are borne by the fund. The fund's first repayment amounted to approximately 10% of the fund's NAV at the time of repayment.

The record date for repayments will in future take place in connection with the publication of the monthly NAV, which is the last day of each month and is published on the first working day of the month. The repayment is effected five working days after NAV publication and is paid pro rata to the Fund's shareholders.

More information and Q&A is available on the Fund's website: https://kreditfonden.se/