We apologize that no monthly newsletter has been published for January. Nothing dramatic has happened since the turn of the year, but there has been a lot of work with annual reports, audits, etc. during February.

Scandinavian Credit Fund I AB (publ) reports a NAV price for February of 59.79. In total, assets have decreased by approximately -1.55% since the beginning of the year. The fund's managed capital amounts to SEK 1,616 million at the end of the month.

A small loan was settled in January, but otherwise no other assets have been realized since the turn of the year.

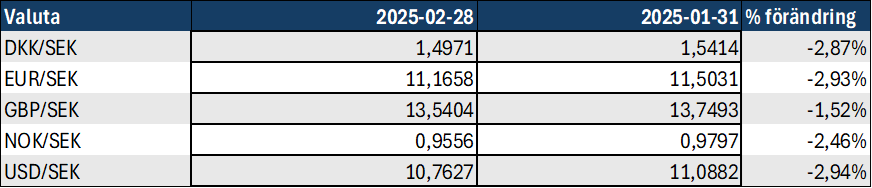

The Swedish krona has strengthened against the portfolio's underlying currencies since the turn of the year, which means that assets in foreign currencies are decreasing in value. The currency changes during February are shown below. The largest movements are against the dollar and euro, where the fund has just over 30% of total assets.

*) As mentioned in previous monthly newsletters, the fund has stopped hedging its holdings as it was considered too expensive and that it also has liquidity effects in connection with the realization of the currency futures. The outcome of the portfolio is affected after we stopped hedging both up and down depending on how the currencies change.

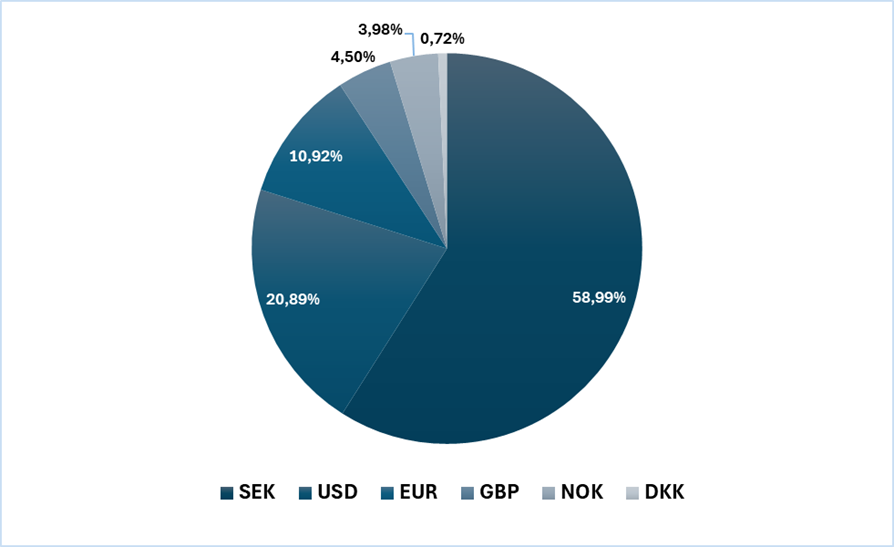

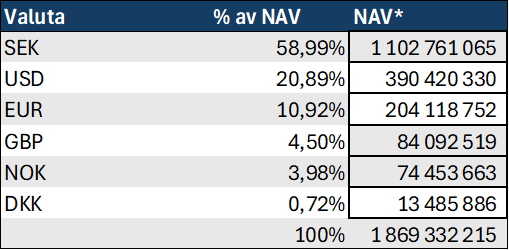

Loans and shares in the portfolio before reserves are distributed in underlying currencies as below.

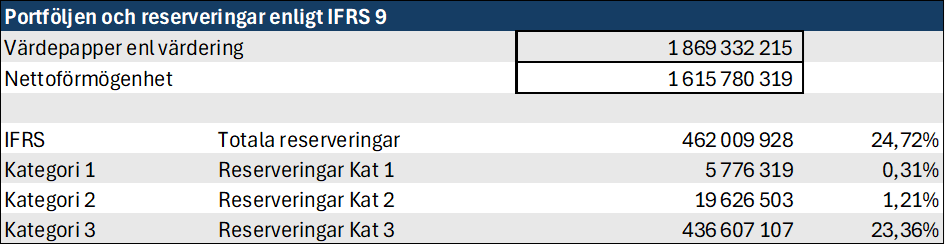

According to the model that the fund applies for reserving the loans, the reserving amounts per category as follows.

The total reserve has not changed much during 2025. The closing reserve as of February 28 amounts to -462.0 million SEK, compared with the reserve at the turn of the year, which amounted to -468.7 million SEK.

Events during the month

The fund published its annual report for 2024 on February 28. The annual report is available on the fund's website, https://kreditfonden.se.

In January, a loan totaling SEK 7.7 million including interest was settled. At the turn of the year, the loan was reported in category 3 and the interest has therefore not been recognized as income earlier. However, this had a less positive impact on the NAV as the loan constituted such a small part of the total portfolio. The fund has tried to get the borrower to pay for a longer period of time without success. When this was unsuccessful, we proceeded with the credit to the Swedish Enforcement Authority as the fund had a mortgage on the borrower's properties. A few weeks before the executive auction in January, the borrower contacted us and wanted to negotiate. The fund maintained its claim including the interest that was unpaid. Two days before the executive auction, the borrower paid the debt including interest according to the loan terms, and the fund withdrew the case from the Swedish Enforcement Authority.

Another case is being pursued by the Swedish Enforcement Authority against a small borrower. The borrower's owner has personally guaranteed the loan and the Swedish Enforcement Authority has seized the person in question. Seized assets include properties and personal belongings. More information about the outcome in upcoming monthly newsletters. The outcome of the ongoing seizure depends on what the seized assets can be sold for. There are more lenders, which also affects the fund's chances of recovery.

The sale of the condominiums developed in Vemdalen is ongoing but is slower than we had hoped. We have lowered the price slightly to speed up the sale. The agent has had a number of viewings and we have made two closings since the sale resumed. Advertisements are available on Hemnet and the agent's website. We have also advertised in the magazine Åka Skidor, both online and in the issue that came out in early February. The advertisements on Hemnet are below.

The Riksbank has continued to lower the key interest rate, which was lowered by -0.25% during January. In total, the interest rate has thus been lowered by -1.75”% since the peak. The more favorable interest rate situation will hopefully lead to increased interest in the developed tenant-owned apartments and the property market in general. However, what will happen in the future is difficult to predict given the geopolitical situation.

Work on properties in Norrtälje and Hallstavik continues. We have been working here to bring in new tenants and improve operating net income. Kronans Apotek will move in in March after the premises in Hallstavik have been adapted. The project has been running according to plan.

The positive trend that we have seen in some of the unlisted companies that the fund has realized is continuing. Sales and results are better than in previous years. The financial statements are being finalized and a dividend from one of the companies is being discussed. Decisions will be made at the meeting in early April.

During January, we also restructured one of the listed holdings in which the fund owns shares. This was done to make the fund's preference shares marketable so that we can eventually realize our holding. As the company is listed, we cannot provide any further information.

Repayment of capital

The fund will make a new repayment of capital in the second quarter at the same level as the previous payment in December. We await the dividend as described above.

More information and Q&A is available on the Fund's website: https://kreditfonden.se as well as in previous monthly newsletters.