Scandinavian Credit Fund I AB (publ) reports a NAV rate for August of 62.64, a decrease of -1.3854% since the previous month. The fund's managed capital amounts to SEK 1,690.8 million at the end of the month. As mentioned in previous monthly letters, the fund has stopped currency hedging the holdings as it was considered too expensive and that it also has a liquidity effect in connection with the realization of the currency futures. The outcome in the portfolio is affected after we stop currency hedging both up and down depending on how the currencies change.

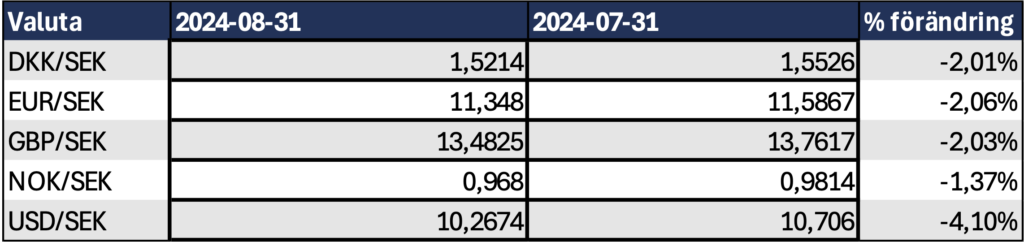

During August, the Swedish krona strengthened against all currencies to which the fund has exposure. The Norwegian krone weakened by -1.37% and the dollar weakened by -4.1%, the change in the fund's currencies is shown below. The decrease in NAV during the month by -1.3854% is largely related to currency changes as the holdings in foreign currency lost value when revalued to Swedish kronor.

During the month, a holding that was previously reserved in category 3 was closed. The fund has assessed that there is no point in pursuing the matter further as it is not possible to recover more from the surety bond that existed as supplementary security. The process in court has also been judged to take a long time and the parties have instead chosen to close the case to avoid more costs from the lawyers who have been involved.

Pledged assets

We work intensively with the holdings, but it takes time. A month can feel like a long time, but in the underlying businesses it is relatively short. We can only refer to your patience.

Hopefully we will get some help from the economy when interest rates are now on the way down, which will facilitate the disposal of the assets that the fund owns.

Refund

We do not have much more to share than what was previously communicated in connection with the publication of the half-yearly report and in previous monthly newsletters. For repayment, one of the mortgaged assets must be sold or the underlying loan repaid. With the maturity structure found in the portfolio, a repayment is expected to take place during the end of Q4 or the beginning of 2025.

More information and Q&A is available on the Fund's website: https://kreditfonden.se as well as in previous monthly newsletters.