Scandinavian Credit Fund I AB (publ) reports a NAV price for October of 54.49, which is a decrease of -1.2 % during the month. During September, the fund fell by -0.46 %. The fund's managed assets amounted to SEK 1,472 million at the end of the month.

The change during the month is mainly due to the listed holdings in the portfolio which have decreased in value as a result of the prices having decreased during the month. The remaining part of the change is partly due to currency changes, where the krona has strengthened during the month against all currencies in the portfolio except for the dollar which had a positive change in October. However, since the previous monthly comment in August, the currency change is negative for all currencies except for the Norwegian krone.

The fund's provisions according to IFRS 9 decreased by SEK 4.6 million during the month.

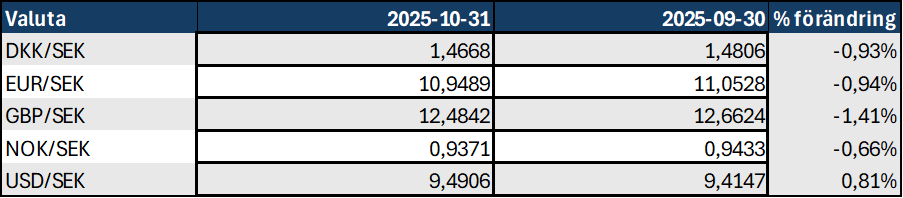

As previously described, the fund is affected by the movement of the Swedish krona against other currencies to which the fund is exposed. The monthly development of the fund's currencies is shown in the table below. Currency changes have affected the portfolio both positively and negatively during the year. Overall, however, during the year we have had a strengthening of the krona, which has meant a weakening of the dollar by -14.2% and by -9.9% against the pound. In total, the change in value is approximately SEK -75 million during the year.

*) As mentioned in previous monthly newsletters, the fund has stopped hedging its holdings as it was considered too expensive and that it also has liquidity effects in connection with the realization of the currency futures. The outcome of the portfolio is affected after we stopped hedging both up and down depending on how the currencies change.

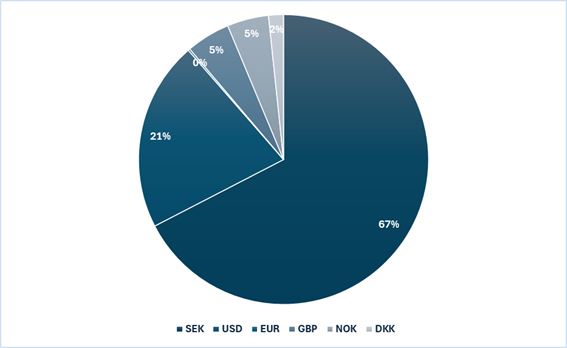

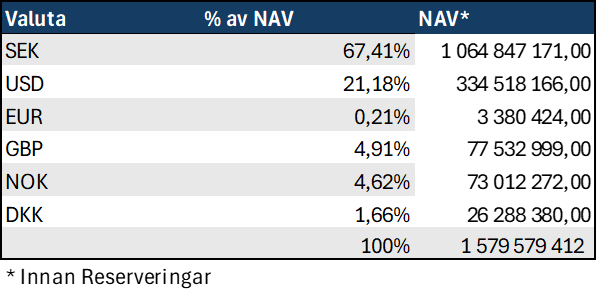

Loans and shares in the portfolio before reserves are distributed in underlying currencies as below.

According to the model that the fund applies for reserving loans, the reserve per category is as follows.

The closing reserve as of October 31 amounts to -260.5 million sek, compared with the reserve in September which amounted to -264.9 million sek.

Events during the month

We have now reached a settlement regarding the case that we previously had with the Swedish Enforcement Authority. A contact related to our debtor pledged shares in a listed company as security for the person's debt in September. The person in question has not paid the debt, so the fund has instead taken over the shares in the listed company according to the settlement. The value of the shares taken over is higher than the original claim and also higher than the fund's book value including reserves. Since the liquidity of the share is low, the divestment will take place under controlled conditions.

The fund is invested in a bond loan that matures in December. Discussions with the company's management have been ongoing since the summer to ensure that the company begins work on refinancing well in advance of the maturity date to ensure repayment to the fund. Our share of the bond loan amounts to just under SEK 40 million. At the end of October, we agreed on a refinancing plan, which resulted in us being paid approximately SEK 14.5 million of the total amount. We expect the remaining payment to arrive at the end of November.

No news regarding the ongoing lawsuit process in Denmark. The fund has previously sued management and auditors. We are working on the process and will report back when we have more information.

Sales of the condominiums in Björnrike are progressing slowly. We have now sold 9 of 15 apartments and new viewings have taken place during November. The winter season is almost here with more visitors in place in Vemdalen, so the opportunities to get rid of the last condominiums should increase. We have had a board meeting in the association during November and all buyers are satisfied, which is nice. Advertising is still on Hemnet and the broker's website.

The work on the properties in Norrtälje and Hallstavik is ongoing and the project with the ventilation in Hallstavik is nearing completion. We have met with real estate agents on site in Hallstavik and have begun preparations for a sale of the property. The marketer has estimated that we will be able to go out with material and test the market in mid-December.

We work actively with all holdings in the portfolio to realize value and free up liquidity.

Repayment of capital

We cannot yet set a date for the next refund, but if everything goes well, we will make another refund before the end of the year.

As mentioned in the previous monthly letter, we have received suggestions about the fund's possibility to repurchase issued Profit Sharing Loans over the stock exchange as part of the management, when the stock exchange price (secondary market) deviates from the fund's monthly NAV (primary market). The issue has been discussed internally and we have concluded that it may be a good idea to do so with a smaller amount of SEK 5-10 million, which we will do in Q4 if the spread between the primary and secondary markets remains.

More information and Q&A is available on the Fund's website: https://kreditfonden.se as well as in previous monthly newsletters.