Scandinavian Credit Fund I AB (publ) reports a NAV price for November of 49.56, which is a decrease of -9.05% compared to the previous month. The fund's managed capital amounts to SEK 1,339 million at the end of the month.

During November, we adjusted the value of two of the holdings, which is the main explanation for the negative return in the portfolio this month. Both holdings remain and there is confidence in a higher value in the long term, but based on current information, we have chosen to adjust the value down. One company is listed on NGM. The company is undergoing a restructuring of its operations, which has been ongoing during the year. As part of the transformation that is being made, the company has divested parts of its operations in order to be able to finance the change. The work of transitioning from the old to the new takes time. In part, the divestment of one of the subsidiaries has dragged on, while deliveries within the new part have also been delayed. This has meant that the company has had difficulty with liquidity during the year. The balance sheet also needs to be strengthened and, in order to enable the change that the company is undergoing, the fund has agreed to carry out a conversion of loans to shares in a rights issue. We have chosen to do this as the company does not have the opportunity to refinance the fund and at the same time as several interesting deals are in the pipeline within the new part.

The second company has had a slightly weaker development during the autumn, which is why we have adjusted the value down. In our opinion, there is potential here going forward, but the current valuation better reflects the current market value.

Other listed holdings in the portfolio also decreased in value due to price declines during the month, which negatively affected returns.

The fund's provisions according to IFRS 9 increased during the month by SEK 9.9 million.

As previously described, the fund is affected by the movement of the Swedish krona against other currencies to which the fund is exposed. The monthly development of the fund's currencies is shown in the table below. Currency changes have affected the portfolio both positively and negatively during the year. Overall, however, during the year we have had a strengthening of the krona, which has meant a weakening of the dollar by -14.7% with -9.7% against the pound, -4.4% against the euro and -4.0% against the Norwegian krone. In total for all currencies, the change in value is approximately SEK -92 million during the year.

| Currency | 2025-11-30 | 2025-10-31 | % change |

| DKK/SEK | 1,4665 | 1,4668 | -0,02% |

| EUR/SEK | 10,952 | 10,9489 | 0,03% |

| GBP/SEK | 12,5019 | 12,4842 | 0,14% |

| NOK/SEK | 0,9327 | 0,9371 | -0,47% |

| USD/SEK | 9,4408 | 9,4906 | -0,52% |

*) As mentioned in previous monthly newsletters, the fund has stopped hedging its holdings as it was considered too expensive and that it also has liquidity effects in connection with the realization of the currency futures. The outcome of the portfolio is affected after we stopped hedging both up and down depending on how the currencies change.

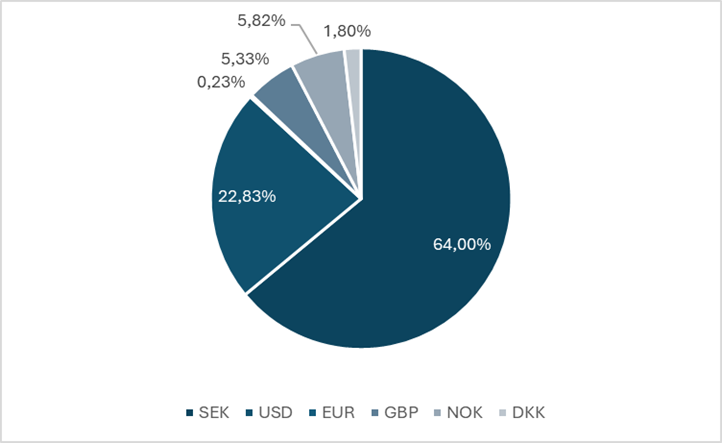

Loans and shares in the portfolio before reserves are distributed in underlying currencies as below.

| Currency | % of NAV | HUB* |

| SEK | 64,00% | 932 919 017,00 |

| USD | 22,83% | 332 762 850,00 |

| EUR | 0,23% | 3 381 381,00 |

| GBP | 5,33% | 77 642 925,00 |

| ENOUGH | 5,82% | 84 771 363,00 |

| DKK | 1,80% | 26 283 003,00 |

| 100% | 1 457 760 539 |

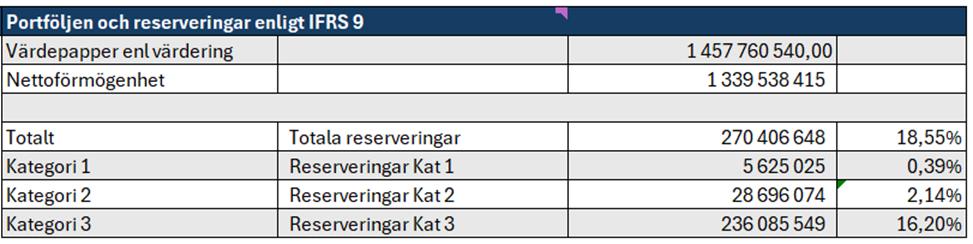

According to the model that the fund applies for reserving loans, the reserve per category is as follows.

The closing reserve as of November 30 amounts to -270.4 million sek, compared with the reserve in October which amounted to -260.5 million sek.

Events during the month

The major changes in the portfolio have been described at the beginning. We have spent a lot of time on both of these holdings during the year and over the past month. Hopefully this will lead to positive results going forward.

We still have the shares that were taken over in the settlement that was reached regarding the borrower against whom we have pursued a case with the Swedish Enforcement Authority. The price has fallen slightly during the month, which is why we have waited with the divestment. Since the liquidity of the share is low, the divestment will be done under controlled conditions. We will do the same with the other smaller holdings that are also listed and in this way increase the cash for more repayments during Q1 2026.

As we announced in October, we have been in dialogue with a company about refinancing a bond loan. The discussion began in August, which has resulted in us now being repaid a total of just under SEK 40 million.

Dialogue is also being held with the agent in another bond in which the fund is invested. The company that issued the bond is bankrupt and work to realize the mortgage in the property that serves as collateral has been ongoing for some time. A potential buyer has shown interest in the property in November and negotiations are ongoing. The fund's net after reservation is in line with the purchase price that has been presented. For the fund, just over SEK 30 million as we are one of several investors in the bond.

Nothing new regarding the ongoing lawsuit process in Denmark. The fund has sued previous management and auditors. The work takes time and we will return when we have more information.

Sales of the condominiums in Björnrike continue. New viewings now in December. A total of 9 out of 15 apartments sold. Advertising still on Hemnet and the real estate agent's website.

Work on the properties in Norrtälje and Hallstavik is ongoing and the ventilation project in Hallstavik is nearing completion. We hope to be able to bring in another new tenant in Hallstavik. This will come if we succeed in demanding adaptation of the premises, but our assessment is that it is worth moving forward if we can sign a longer lease.

We work actively with all holdings in the portfolio to realize value and free up liquidity.

Repayment of capital

We will repay SEK 42 million, equivalent to 3.14% of NAV as of the end of November and 1.56% of the outstanding nominal amount. Payment will be made via Euroclear on December 23 to the respective custodian institution and will then be booked out to your custodians.

Buybacks over the stock exchange as part of the management, when the stock exchange price (secondary market) deviates from the fund's monthly NAV (primary market). Will be tested in January with a smaller amount of SEK 5-10 million if the spread between the primary and secondary markets remains.

More information and Q&A is available on the Fund's website: https://kreditfonden.se as well as in previous monthly newsletters.