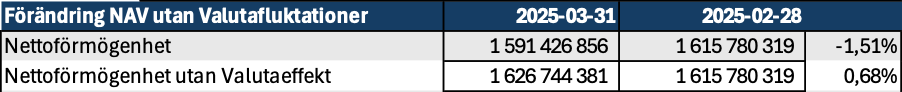

Scandinavian Credit Fund I AB (publ) reports a NAV price for March of 59.79. In total, assets have decreased by approximately -1.52% since the previous month. The fund's managed capital amounts to SEK 1,591 million at the end of the month.

The result during the month has been largely affected by the strengthening of the krona against the portfolio's currencies. The currency effect amounts to a total of approximately -35 MSEK, corresponding to -2.2%. Without the large currency movement during the month, the managed capital would have been +0.68% during March.

The exchange rate changes by currency are shown below. The largest movements are against the dollar and pound.

*) As mentioned in previous monthly newsletters, the fund has stopped hedging its holdings as it was considered too expensive and that it also has liquidity effects in connection with the realization of the currency futures. The outcome of the portfolio is affected after we stopped hedging both up and down depending on how the currencies change.

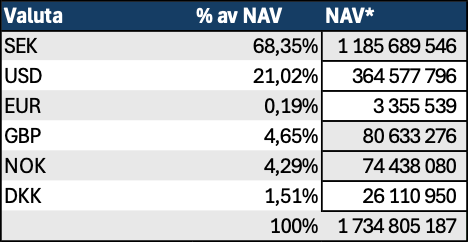

Loans and shares in the portfolio before reserves are distributed in underlying currencies as below.

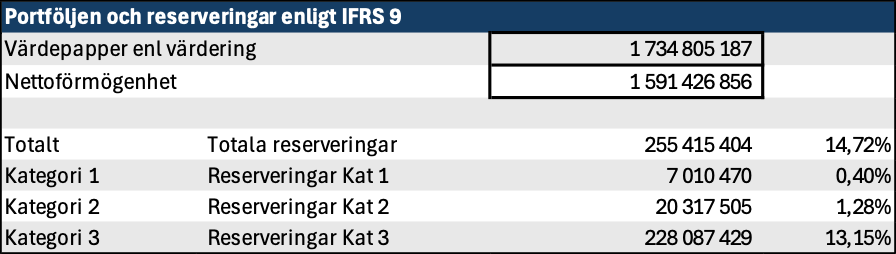

According to the model that the fund applies for reserving loans, the reserve per category is as follows.

The closing reserve as of March 31 amounted to SEK -255.4 million, compared with the reserve at year-end, which amounted to SEK -468.7 million. The change consists partly of a change in a commitment that has been moved to Category 1 and the derecognition of a commitment that we have previously written down but which we have now chosen to remove.

Events during the month

During the month, the fund has extended a loan to one of the companies in which the fund is a shareholder. The loan amounts to a total of SEK 27 million. We already have previous loans to the company amounting to SEK 30 million. The loan is short-term financing to support the company during the ongoing restructuring of its operations. In connection with the loan, the fund has significantly strengthened its collateral. The company will divest parts of its operations as part of the restructuring and the fund has taken into account the bids received from various stakeholders in its assessment of the new loan. This, together with the other information we have received, makes us feel confident about the increased commitment. The loan is to be settled by the end of June 2025 at the latest and is on good terms. However, the ongoing sales process is expected to be completed before then, and the fund is expected to be fully repaid in connection with that transaction. Through the collateral the fund has after the expansion of the loan, we have created a better and faster opportunity to secure repayment of the previously issued loan.

Nothing new has happened with the smaller credit that we informed about in the previous monthly letter, where the fund is running the case with the help of the Swedish Enforcement Authority. The borrower's owner has personally guaranteed the credit and the Swedish Enforcement Authority has seized assets consisting of, among other things, real estate and personal belongings. The outcome of the ongoing seizure depends on what the seized assets can be sold for. There are more lenders, which also affects the fund's chances of recovery.

In Vemdalen we have sold another condominium and there is interest from some speculators. We hope that Easter will be able to get more interested, but it is going slower than we had hoped even though we have lowered the price slightly. The advertisement is out on Hemnet and the broker's website.

The Riksbank left the policy rate unchanged at 2.25% at the meeting on March 20. The recent period has been very turbulent, characterized by the trade war that has now been started by the USA. The stock markets and the currency market have been greatly affected, which does not make the work of divesting the fund's assets easier.

We are continuing to work with the properties in Norrtälje and Hallstavik to reduce the vacancy rate and raise the rent level. Kronans Apotek, which we informed about earlier, has now moved in and is very satisfied with the new premises. The official opening took place in early April.

The positive trend that we have seen in some of the unlisted companies that the fund has realized is continuing and the companies are following budget so far. Sales and results are better than in previous years. How the trade war that has begun will affect the companies is difficult to predict. One of the companies, which has a large part of its sales to the USA, has been foresighted and already increased its inventories in the USA at the end of 2024 to create a buffer against upcoming tariffs. We are in almost constant contact with the CEOs of the respective companies every week. We have also recently met with the entire management of two of the companies and our impressions are good.

Repayment of capital

The fund will make a new repayment of capital in the second quarter at the same level as the previous payment in December. We will return with further information as soon as we can.

More information and Q&A is available on the Fund's website: https://kreditfonden.se as well as in previous monthly newsletters.