Scandinavian Credit Fund I AB (publ) reports a NAV price for March of 57.71. In total, assets have decreased by approximately -0.85% since the previous month. The fund's managed capital amounts to SEK 1,560 million at the end of the month.

As earlier in the year, the krona has continued to strengthen against other currencies except against the pound and Norwegian kroner. The currency effect largely explains the entire decrease in NAV during the month. With unchanged exchange rates, the NAV would have decreased by -0.16%.

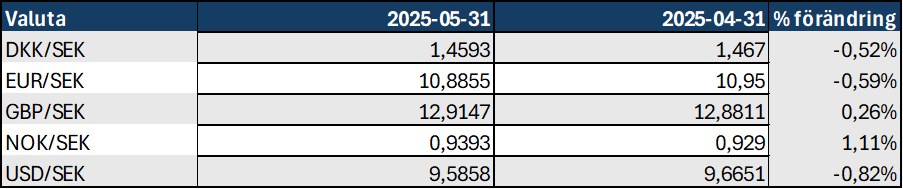

The currency changes per currency are shown below. The largest movements are against the dollar and Norwegian kroner, although in different directions.

*) As mentioned in previous monthly newsletters, the fund has stopped hedging its holdings as it was considered too expensive and that it also has liquidity effects in connection with the realization of the currency futures. The outcome of the portfolio is affected after we stopped hedging both up and down depending on how the currencies change.

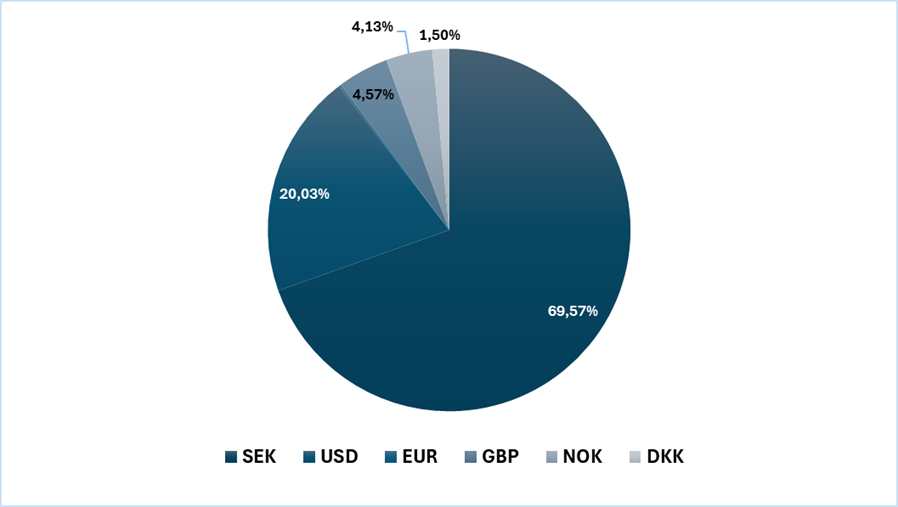

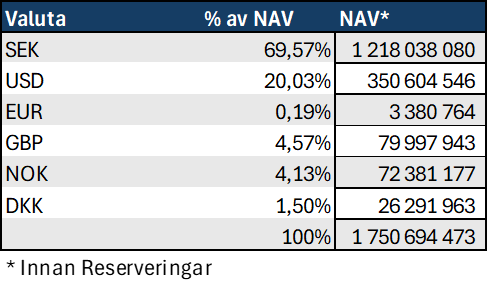

Loans and shares in the portfolio before reserves are distributed in underlying currencies as below.

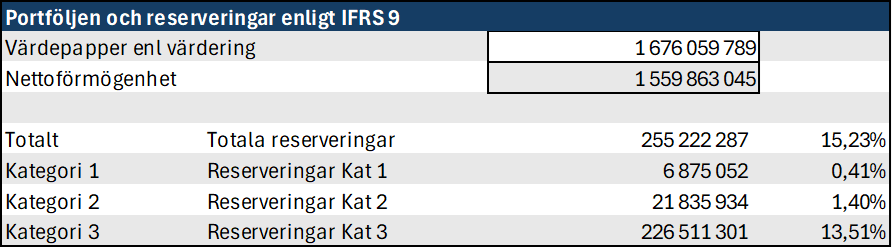

According to the model that the fund applies for reserving loans, the reserve per category is as follows.

The closing reserve as of May 31 amounts to SEK -255.2 million, compared with the reserve in April, which amounted to SEK -253.4 million. One commitment has been moved from category 1 to category 2, which has increased the provision slightly.

Events during the month

We are waiting for repayment of a loan that was scheduled for the beginning of June. The borrower who sold parts of the business is in turn waiting for payment from the buyer. We cannot therefore announce when our planned payment for June will be made until we have the payment in our account with certainty.

In previous monthly letters, we have informed about a case that the fund is pursuing with the help of the Swedish Enforcement Authority. The owner of the company to which the fund has lent has given personal guarantee for the company's obligations. The Swedish Enforcement Authority has now completed the seizure of the owner's property and has seized movable property and three properties. An auction of the movable property has begun. If the assets are sold for the value assessed by the Swedish Enforcement Authority, the fund will be largely repaid for our entire claim, but not more than approximately SEK 7 million.

Regarding the ongoing lawsuit process in Denmark. The fund has sued previous management and auditors. The fund is actively working on the process and will return when we have more information.

Nothing new regarding the condominiums in Vemdalen. We will hold an association meeting with the members before the end of June. Our broker is working on the sale of the remaining apartments in Vemdalen. The market during the summer months is somewhat calmer, but we see potential going forward and are working on selling the entire project. Advertising is available on Hemnet and the broker's website.

Work on the properties in Norrtälje and Hallstavik is ongoing and a project with the ventilation at the district dental care will begin shortly. One of the tenants in Pelikanen has terminated his lease. We have tried to renegotiate but the tenant has chosen to change premises. The matter was handled by the rental committee and the agreement now runs until August 31, 2026. Active work is underway to find a new tenant for the premises. The plan is, as before, to resume contact with brokers during Q3 and then primarily with the sale of the property in Hallstavik.

The development in some of the unlisted companies that the fund has realized as collateral remains good. Sales and results are better than in previous years through April. Dividend raised by SEK 10 million after the general meeting in one of the companies that accrues to the fund. We will work for another dividend in the autumn.

We are receiving a lot of questions about the active winding down process. To provide more information and answer the questions we can, we will be holding a webinar on June 26 at 3:00 PM. Some of the questions may be of the same nature and in order to provide the best possible answers, please send your questions to scfi@kreditfonden.se in advance. We will also try to answer questions directly in the chat in the webinar to the best of our ability.

You register at https://kreditfonden.se/webbinar-scandinavian-credit-fund-i-med-mats-johansson-26-juni-2025-kl-1500/

Repayment of capital

We will get back to you with more information as soon as we can.

More information and Q&A is available on the Fund's website: https://kreditfonden.se as well as in previous monthly newsletters.