Scandinavian Credit Fund I AB (publ) reports a NAV price for June of 57.83, which is an increase of +1.74% during the month. The fund's managed assets at the end of the month amounted to SEK 1,561 million.

The month's increase is largely due to two main reasons. Firstly, the value of two of the fund's listed holdings increased, resulting in an increase in value of just under SEK 18 million. We naturally hope that the change is permanent and that the shares continue to rise in value somewhat before they are divested, however, the liquidity of each share may affect the timing. The second main reason is related to the holdings in foreign currency. The dollar strengthened during the month by 3.46% compared to the Swedish krona. The total currency effect amounts to approximately SEK 12 million.

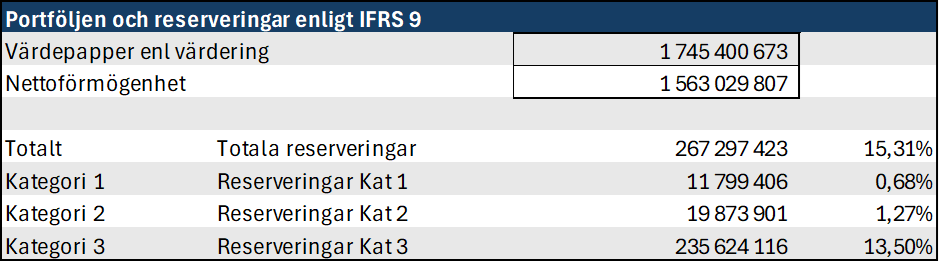

The fund's provisions according to IFRS 9 increased during the month by SEK -4.4 million. The increase in provisions is attributable to one of the commitments in category 1 as a result of a change in the underlying collateral value.

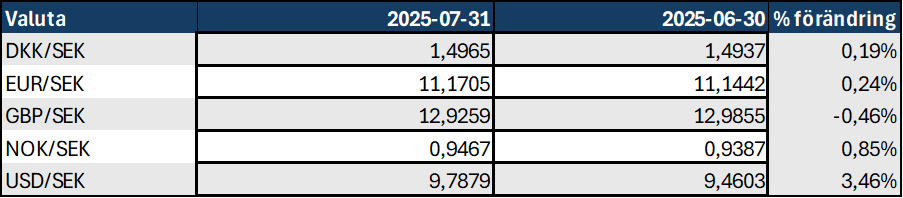

As previously described, the fund is affected by the movement of the Swedish krona against other currencies the fund is exposed to. The monthly development of the fund's currencies is shown in the table below.

*) As mentioned in previous monthly newsletters, the fund has stopped hedging its holdings as it was considered too expensive and that it also has liquidity effects in connection with the realization of the currency futures. The outcome of the portfolio is affected after we stopped hedging both up and down depending on how the currencies change.

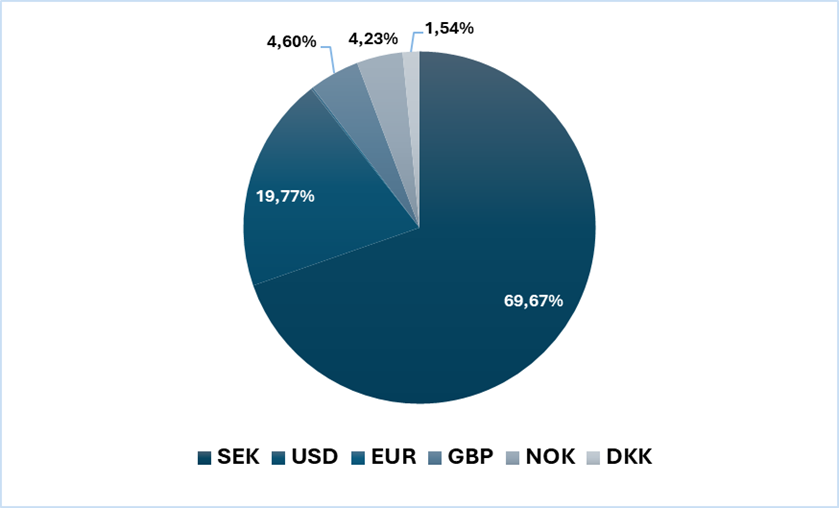

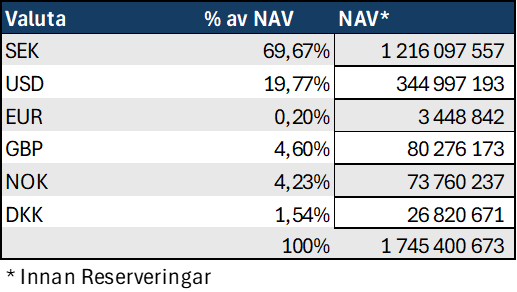

Loans and shares in the portfolio before reserves are distributed in underlying currencies as below.

According to the model that the fund applies for reserving loans, the reserve per category is as follows.

The closing reserve as of July 31 amounted to -267.3 million SEK, compared with the reserve in June, which amounted to -262.8 million SEK.

Events during the month

The fund will make a repayment of SEK 40 million on August 28. We have been waiting for the redemption of a loan and had hoped to make a larger payment than we are now making. Since we still have not received the cash we were waiting for, we are now making this repayment so as not to have too much cash ourselves. We still have a buffer left to be able to support our holdings if necessary.

It has otherwise been a quiet month. The projects that are underway are continuing.

The fund has only received a small payment from the Swedish Enforcement Authority from the seizure we reported on earlier. We are communicating with the administrator to expedite the matter.

No news regarding the ongoing lawsuit process in Denmark. The fund has sued previous management and auditors. We are actively working on the process and will report back when we have more information.

Sales of the condominiums in Björnrike continue. We have another interested party in one of the large apartments so things are progressing slowly. If we manage to get the sale, we will have sold half of the apartments. Advertising is still on Hemnet and the real estate agent's website.

Work on the properties in Norrtälje and Hallstavik is ongoing and the project with the ventilation at the district dental care is ongoing and is expected to be completed by the end of August. The plan is, as before, to resume contact with brokers during Q3, primarily with the sale of the property in Hallstavik.

The development in some of the unlisted companies that the fund has realized remains good. However, one of the holdings has had a weaker development in recent months. We await the report for June/July and hope that the development will turn around so that the forecast for 2025 can be fulfilled.

Repayment of capital

We will repay SEK 40 million, equivalent to 2.56% of NAV as of the end of July. Payment will be made via Euroclear on August 28 to the respective depository institution and will then be booked out to your custody accounts.

During the spring and summer, we have received suggestions that the fund has the opportunity to repurchase issued Profit Sharing Loans over the stock exchange as part of the management, as the stock exchange price (secondary market) deviates from the fund's monthly NAV (primary market). The issue has been discussed internally and we have concluded that it may be a good idea to do so with a smaller amount of SEK 5-10 million, which we will do later this autumn if the spread between the primary and secondary markets remains.

More information and Q&A is available on the Fund's website: https://kreditfonden.se as well as in previous monthly newsletters.