Scandinavian Credit Fund I AB (publ) reports a NAV price for November of 47.14, which is a decrease of -4.9% compared to the previous month including the amortization made during December of a total of SEK 42 million. The fund's managed capital amounts to SEK 1,274 million at the end of the month.

The change during the month is due to -3.1% due to the amortization made during the month, -0.7% due to currency effects due to the continued strengthening of the krona against the other currencies in the portfolio, -1.1% due to increased provisions and other value changes.

The listed holdings in the portfolio decreased slightly in value due to price declines during the month but did not affect NAV by more than -0.1%.

The fund's provisions according to IFRS 9 increased during the month by SEK 16.3 million.

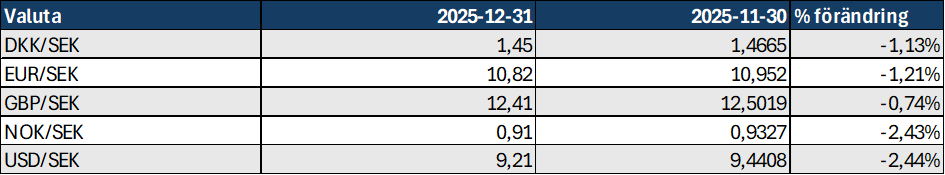

As previously described, the fund is affected by the movement of the Swedish krona against other currencies the fund is exposed to. The monthly development of the fund's currencies is shown in the table below. Currency changes have affected the portfolio both positively and negatively during the year. Overall, however, during the year we have had a strengthening of the krona, which has meant a weakening of the dollar by -16.8% with -10.4% against the pound, -5.6% against the euro and -6.40% against the Norwegian krone. In total for all currencies, the change in value is just over SEK -100 million during the year.

*) As mentioned in previous monthly newsletters, the fund has stopped hedging its holdings as it was considered too expensive and that it also has liquidity effects in connection with the realization of the currency futures. The outcome of the portfolio is affected after we stopped hedging both up and down depending on how the currencies change.

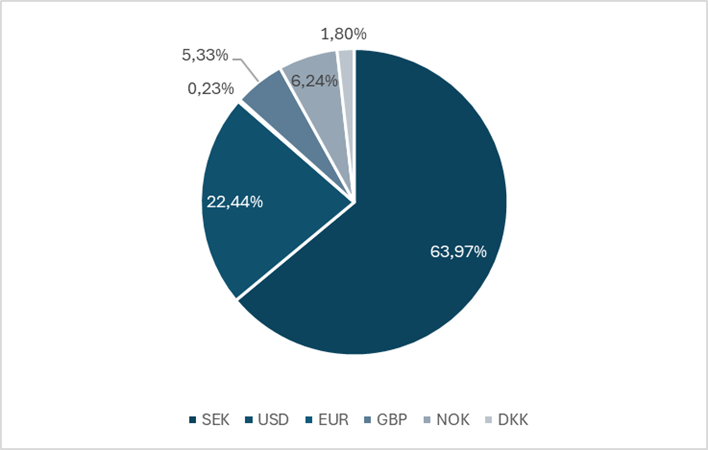

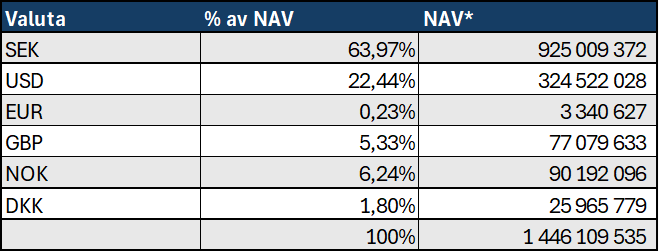

Loans and shares in the portfolio before reserves are distributed in underlying currencies as below.

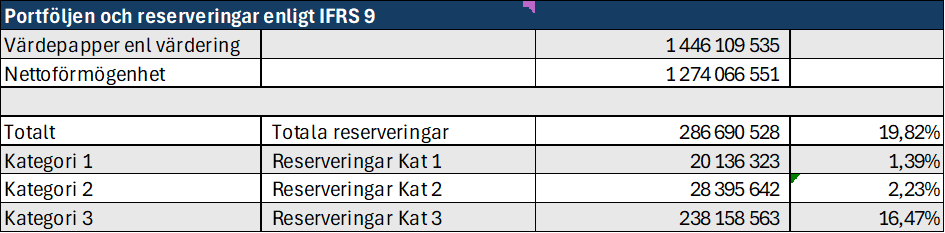

According to the model that the fund applies for reserving loans, the reserve per category is as follows.

The closing reserve as of December 31 amounts to -286.7 million sek, compared with the reserve in November which amounted to -270.4 million sek.

Events during the month

During December, we worked intensively on the sale of three of the holdings in the portfolio and managed to close them before December 31. The properties in Norrtälje and Hallstavik are included in the divested holdings. We have sold the companies that own the properties to a listed company and will receive payment partly in cash and partly in the form of newly issued shares. The buyer will make further acquisitions in the coming year and we are positive about the future development for the new buyer. The cash portion will be received during the first quarter. The shares will be received within just over a month when the issue is complete. We have no lock-up on the shares but intend to divest in an orderly manner during the year. The third holding has been divested to the management of the company with the aim of further increasing the profit from the operations in order to make an external exit in the next stage.

In 2025, we have also worked with Vimab Group, where we are both shareholders and lenders. In December, we agreed with the company to guarantee a rights issue and convert the fund's outstanding loans totaling SEK 70.3 million into shares in the company. In total, the company will be provided with SEK 100.9 million in new capital, of which just over SEK 30 million in new liquidity from other shareholders. The company is undergoing a transformation and has several interesting deals underway in energy storage that have been communicated during the year. The lead times in the deals are long as several international partners are involved, but the company expects these to begin to materialize in 2026. The rights issue strengthens the company's balance sheet and provides the conditions for continuing the transformation of the business towards energy storage.

During December we have also negotiated a smaller holding where the parent company is now bankrupt. We have mortgages in three of the company's subsidiaries and are working with management and the central bank to be able to realise these and obtain repayment. We hope to be able to complete this at the end of January/beginning of February.

No news regarding the bond that we informed about in the previous monthly letter. The company that issued the bond is bankrupt and work to realize the mortgage on the property that serves as collateral has been ongoing for some time. A potential buyer has shown interest in the property during November and negotiations are ongoing. The fund's net after reservation is in line with the purchase price that has been presented. For the fund, just over SEK 30 million as we are one of several investors in the bond.

Nothing new regarding the ongoing lawsuit process in Denmark. The fund has sued previous management and auditors. The work takes time and we will return when we have more information.

Sales of the condominiums in Björnrike continue. We have not sold any more apartments. A total of 9 out of 15 apartments sold. Advertising still on Hemnet and the real estate agent's website.

Repayment of capital

We expect to be able to make further repayments during Q1 or early Q2. We will return with the amount and timing of the repayment later. We will also make a smaller buyback of shares over the stock exchange as communicated earlier if the spread between the primary and secondary markets remains.

More information and Q&A is available on the Fund's website: https://kreditfonden.se and in previous monthly newsletters.sa before December 31. The properties in Norrtälje and Hallstavik are included in the divested holdings. We have sold the companies that own the properties to a listed company and will be paid partly in cash and partly in the form of newly issued shares. The buyer will make further acquisitions in the coming year and we are positive about the future development for the new buyer. The cash portion will be received during the first quarter. The shares will be received within just over a month when the issue is complete. We have no lock-in on the shares but intend to divest in an orderly manner during the year. The third holding has been divested to the management of the company with the aim of being able to further increase the profit from the operations in order to make an external exit in the next stage.

In 2025, we have also worked with Vimab Group, where we are both shareholders and lenders. In December, we agreed with the company to guarantee a rights issue and convert the fund's outstanding loans totaling SEK 70.3 million into shares in the company. In total, the company will be provided with SEK 100.9 million in new capital, of which just over SEK 30 million in new liquidity from other shareholders. The company is undergoing a transformation and has several interesting deals underway in energy storage that have been communicated during the year. The lead times in the deals are long as several international partners are involved, but the company expects these to materialize in 2026. The rights issue strengthens the company's balance sheet and provides the conditions for continuing the transformation of the business towards energy storage.

During December we have also negotiated a smaller holding where the parent company is now bankrupt. We have mortgages in three of the company's subsidiaries and are working with management and the central bank to be able to realise these and obtain repayment. We hope to be able to complete this at the end of January/beginning of February.

No news regarding the bond that we informed about in the previous monthly letter. The company that issued the bond is bankrupt and work to realize the mortgage on the property that serves as collateral has been ongoing for some time. A potential buyer has shown interest in the property during November and negotiations are ongoing. The fund's net after reservation is in line with the purchase price that has been presented. For the fund, just over SEK 30 million as we are one of several investors in the bond.

Nothing new regarding the ongoing lawsuit process in Denmark. The fund has sued previous management and auditors. The work takes time and we will return when we have more information.

Sales of the condominiums in Björnrike continue. We have not sold any more apartments. A total of 9 out of 15 apartments sold. Advertising still on Hemnet and the real estate agent's website.

Repayment of capital

We expect to be able to make further repayments during Q1 or early Q2. We will return with the amount and timing of the repayment later. We will also make a smaller buyback of shares over the stock exchange as communicated earlier if the spread between the primary and secondary markets remains.

More information and Q&A is available on the Fund's website: https://kreditfonden.se as well as in previous monthly newsletters.