Scandinavian Credit Fund I AB (publ) reports a NAV price for August of 55.42, which is a decrease of -4.17% during the month. The fund's assets under management amounted to SEK 1,496 million at the end of the month.

The change during the month is due to -2.5% on the payment of SEK 40 million made on August 28. The remaining part of the change is due partly to currency changes, where the krona strengthened against all currencies in the portfolio during the month and partly to a price drop on the listed holdings owned by the fund. The latter has an impact of approximately -0.4%, the rest is largely a currency effect.

The fund's provisions according to IFRS 9 decreased by SEK 2.4 million during the month.

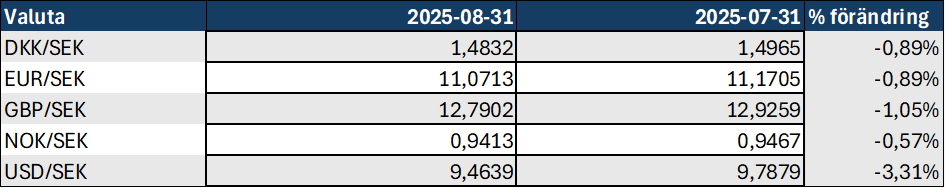

As previously described, the fund is affected by the movement of the Swedish krona against other currencies to which the fund is exposed. The monthly development of the fund's currencies is shown in the table below. Currency changes have affected the portfolio both positively and negatively during the year. Overall, however, during the year we have had a strengthening of the krona, which has meant a weakening of the dollar by -14.5% and by -7.7% against the pound.

*) As mentioned in previous monthly newsletters, the fund has stopped hedging its holdings as it was considered too expensive and that it also has liquidity effects in connection with the realization of the currency futures. The outcome of the portfolio is affected after we stopped hedging both up and down depending on how the currencies change.

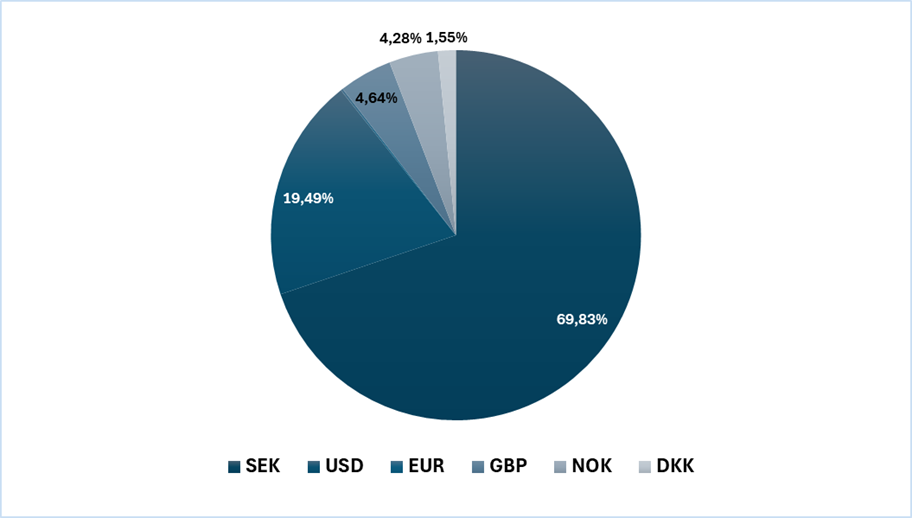

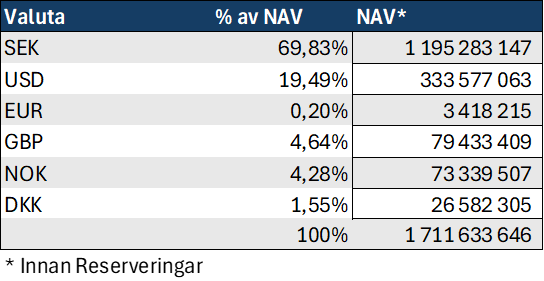

Loans and shares in the portfolio before reserves are distributed in underlying currencies as below.

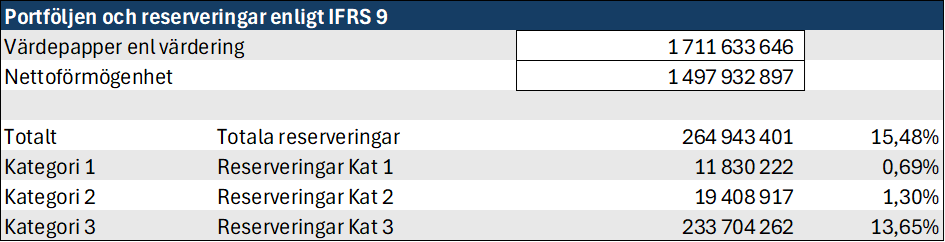

According to the model that the fund applies for reserving the loans, the reserving amounts per category as follows.

The closing reserve as of August 31 amounted to SEK -264.9 million, compared with the reserve in July, which amounted to SEK -267.3 million.

Events during the month

The repayment of SEK 40 million was carried out as planned. The payment was deducted by Euroclear from the fund's account on August 28 and paid to the respective custodian institution. If the payment has not reached you as an investor, please contact your bank or securities institution as the fund is not involved in the distribution to the respective client's custody account.

We are continuing to work to realize additional assets and loans to enable new payments.

August, like July, has been a quiet month. The projects that are underway are continuing.

The fund has only received a small payment from the Swedish Enforcement Authority from the seizure we reported on earlier. We are communicating with the administrator to expedite the matter.

No news regarding the ongoing lawsuit process in Denmark. The fund has sued previous management and auditors. We are actively working on the process and will report back when we have more information.

Sales of the condominiums in Björnrike continue. We have now sold 8 of 15 apartments so things are progressing slowly. Hopefully we can sell a few more before the coming winter. Advertising is still on Hemnet and the real estate agent's website.

Work on the properties in Norrtälje and Hallstavik is ongoing and the project with the ventilation at the district dental care is in the final phase. The plan is as before to resume contact with the broker when the work on the properties is complete. In the first instance, we will proceed with a sale of the property in Hallstavik.

The development in some of the unlisted companies that the fund has realized remains good. As previously reported, we have had a slightly weaker development in recent months in one of our holdings. We await the report for August and hope that the development will turn around so that the forecast for 2025 can be fulfilled.

Repayment of capital

No new repayment is currently planned. We are actively working with all holdings in the portfolio to realize value and free up liquidity. The ambition is to be able to make further repayments.

As mentioned in the previous monthly letter, we have received suggestions that the fund has the opportunity to repurchase issued Profit Sharing Loans over the stock exchange as part of the management, when the stock exchange price (secondary market) deviates from the fund's monthly NAV (primary market). The issue has been discussed internally and we have concluded that it may be a good idea to do so with a smaller amount of SEK 5-10 million, which we will do in Q4 if the spread between the primary and secondary markets remains.

More information and Q&A is available on the Fund's website: https://kreditfonden.se as well as in previous monthly newsletters.