Scandinavian Credit Fund I AB (publ) reports a NAV price for March of 58.21. In total, assets have decreased by approximately -1.15% since the previous month. The fund's managed capital amounts to SEK 1,573 million at the end of the month.

As earlier in the year, the krona has continued to strengthen against other currencies, which has a negative impact on foreign currency holdings. The currency effect during the month amounts to approximately SEK -14 million, corresponding to -0.9 %. Without the large currency movement during the month, the managed capital would have been -0.28% during April.

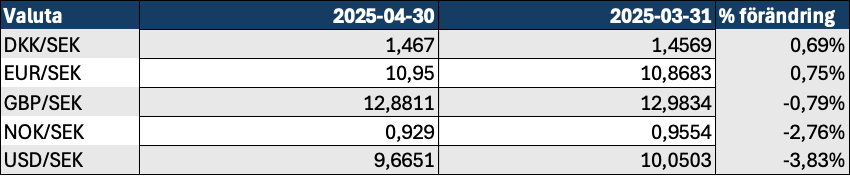

The exchange rate changes per currency are shown below. The largest movements are against the dollar and Norwegian kroner.

*) As mentioned in previous monthly newsletters, the fund has stopped hedging its holdings as it was considered too expensive and that it also has liquidity effects in connection with the realization of the currency futures. The outcome of the portfolio is affected after we stopped hedging both up and down depending on how the currencies change.

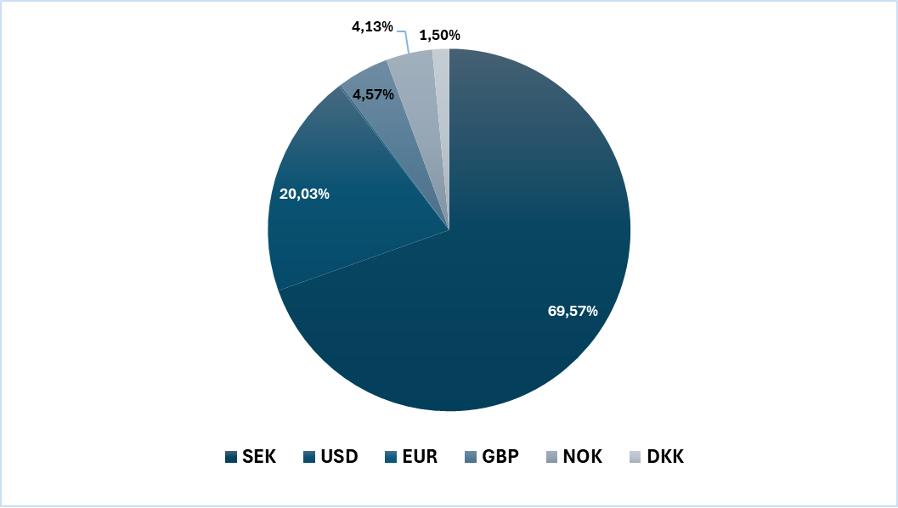

Loans and shares in the portfolio before reserves are distributed in underlying currencies as below.

According to the model that the fund applies for reserving loans, the reserve per category is as follows.

The closing reserve as of April 30 amounts to SEK -253.4 million, compared with the reserve at year-end, which amounted to SEK -468.7 million. The change consists partly of a change in a commitment that has been moved to Category 1 and the derecognition of a commitment that we have previously written down but which we have now chosen to remove.

Events during the month

In the previous monthly newsletter we reported that we had extended a loan to a company in which the fund is also a shareholder. According to our latest contacts with the company, we will now be repaid at the beginning of June. The share, which is listed, increased slightly in value during the month. The company is in a transition and has taken two major orders within the area of operations that it is now focusing on.

Nothing new has happened with the smaller credit that we informed about in previous monthly letters, where the fund is running the case with the help of the Swedish Enforcement Authority. The borrower's owner has personally guaranteed the credit and the Swedish Enforcement Authority has seized assets consisting of, among other things, real estate and personal belongings. The outcome of the ongoing seizure depends on what the seized assets can be sold for. There are more lenders, which also affects the fund's chances of recovery.

The fund has also filed a lawsuit with the help of Danish lawyers against the management and auditors of a Danish energy company in which the fund was invested in a bond issued by the company. We hope to be successful in this process.

Still a bit slow in Vemdalen. Contract for another condominium sent out for signing. Our broker is working on it so we have to let time take its course. Advertising is available on Hemnet and the broker's website.

The Riksbank left the policy rate unchanged at 2.25% at the meeting on May 8, but at the same time opened the possibility that the rate may be lowered further in the future. The recent unrest has had a strong impact on the stock markets and the foreign exchange market, which does not make the work of divesting the fund's assets easier.

Work on the properties in Norrtälje and Hallstavik continues. We have now renegotiated the lease contract with the District Housing Authority in Hallstavik and now have a seven-year lease. During the summer, we will tackle the ventilation in the building and make some other necessary adjustments that have been neglected. Through the measures, we will have lower heating costs, a better indoor climate and an improved operating net. We now have three good anchor tenants, Handelsbanken, Distriktstandvården and Apoteket in our properties. During Q3, we will resume contact with the brokers that we showed the property to at the beginning of the year to try to make a sale.

Development in some of the unlisted companies that the mortgage fund has realized remains good. Turnover and results are better than in previous years. We have recently held a general meeting in one of the companies and will raise a dividend that will contribute to the repayment planned in June, see more below.

Repayment of capital

The fund will make a new repayment of capital in June, the ambition is to be able to make the payment before midsummer at the same level as the previous payment made in December. We will return with more information as soon as we can.

More information and Q&A is available on the Fund's website: https://kreditfonden.se as well as in previous monthly newsletters.